Montana’s farmland values continue moderate downward trend in latest USDA estimates

November 22, 2021

By Dan Bigelow

In August, the U.S. Department of Agriculture’s National Agricultural Statistics Service

(NASS) released their annual farmland value estimates for 2021. The NASS estimates are derived from a survey, administered each June, in which farm operators are asked to estimate the market

value of their land. For states with property transaction price non-disclosure rules,

such as Montana, the NASS estimates represent one of the only publicly available sources

of farmland value estimates.

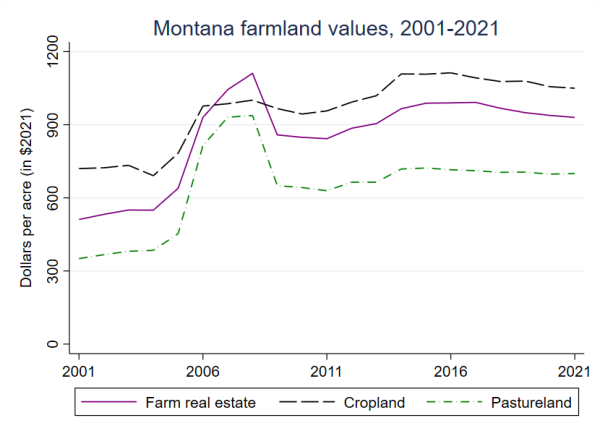

Per the latest survey, after adjusting for inflation using the Federal Reserve’s GDP

implicit price deflator, the values of cropland ($1,050/acre) and total farm real

estate ($930/acre; all farmland and farm-related buildings) exhibited year-on-year

declines of 1%. The declines for cropland were similar in relative magnitude, at roughly

1%, for both nonirrigated ($835/acre) and irrigated ($3,050/acre) land. Pastureland

value ($700/acre), in contrast, increased over the past year, albeit slightly (< 1%).

In part, these changes reflect the high rate of inflation that has overtaken the US

economy since 2020, which pushes up the real value of farmland from previous years.

In fact, in nominal terms (i.e., without the inflation adjustment), cropland and farm

real estate values actually increased by 2% over the past year, while pastureland

value increased by 3%.

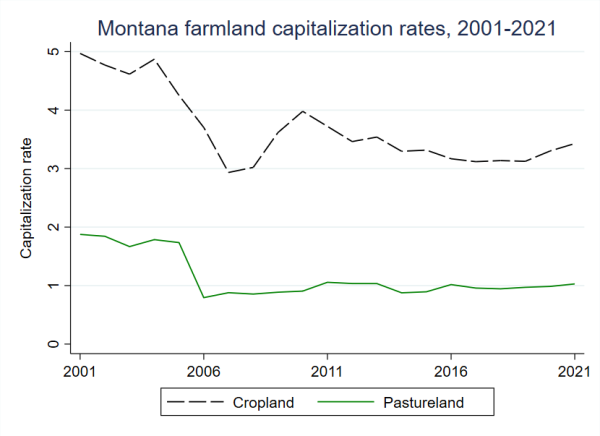

Cash rents showed inflation-adjusted gains between 2020 and 2021, increasing by 3%

for cropland (to $36/acre) and 5% for pastureland ($7.20/acre). Renting land tends

to be less common in Montana compared to other states, but cash rents are generally

thought to be a reasonable proxy for net operating income. By taking the ratio of

cash rent to land value, we arrive at the simplest version of the farmland capitalization

rate (or “cap rate”), which measures the fraction of the land’s purchase price covered

by annual proceeds from renting out the land. For example, a cap rate of 5, implies

that the purchase price of the land will be fully paid for through rental income after

about 20 years (since 100/5 = 20). As shown in the second figure, the combination

of recent land value and cash rent changes has put upward pressure on the cap rate

for both cropland and pastureland. At a current level of 3.43%, the cropland cap rate

is at its highest level since 2013. The pastureland cap rate, at 1.03%, is also at

its highest level since 2013.

In terms of where farmland values may be headed, one major thing to keep an eye on

over the coming year is what happens to interest rates, which are inversely related

to the value of long-held assets, such as land. The recent persistence of low interest

rates is thought to have been a major driver of stubbornly high farmland values over the past several years. If economy-wide inflation continues to run high, the

Federal Reserve may need to revise their target benchmark interest rate target upward, which would eventually put downward pressure on farmland values.