Accessing a Deceased Person's Financial Accounts

MT200301HR

Revised December 2023

By Marsha Goetting, Ph.D., CFP®, CFCS, Extension Family Economics Specialist and Professor, Montana State University

Describes how heirs of a deceased person can access financial accounts, depending

on whether the accounts were owned jointly with other individuals, had payable-ondeath

registrations or transfer-on-death designations, or had no designated beneficiary.

WHEN A MONTANA RESIDENT DIES, STATE LAW PROVIDES a process for determining who is legally entitled to inherit their financial accounts

with banks, credit unions, savings banks, or other entities such as brokerage firms

and stocks or bonds companies. However, if the owner signed an account agreement,

that agreement may contain a financial institution’s default inheritance rules that

would supersede Montana law. This is true if a deceased person owned the account individually

(not jointly) and did not make a POD beneficiary designation.

The purpose of this MontGuide is to briefly describe how heirs (successors) can acquire a decedent’s (deceased person’s) financial accounts under Montana law when the following circumstances exist:

- When the decedent’s account is owned jointly with other individuals;

- When the decedent was the only owner on the account and had designated one or more beneficiaries; and

- When the decedent was the only owner on the account and no beneficiary was designated.

Montana property and contract laws, provisions under the Montana Uniform Probate Code,

and a signed account agreement dictate who becomes the legal successors of the accounts

above.

Procedures

When an individual who claims to be a successor approaches a financial institution

to request money in an account or securities owned by the decedent, a representative

of the financial institution will review the account documents that were signed by

the decedent when the account was established.

The answers to the following questions will help the financial entity determine who

is entitled to the funds in the account.

Was the account jointly owned by the decedent with others and, if so, what are their names? Did the joint account

indicate right of survivorship or without right of survivorship on the form? Did the joint account have a payable on death (POD) beneficiary designation or transfer on death (TOD) beneficiary registration?

If the decedent was the sole owner, did they make a payableon death (POD) beneficiary designation or transfer on death

(TOD) beneficiary registration? If the decedent was the sole owner and did not add

a POD beneficiary designation or TOD registration, a signed account agreement with

that financial institution may contain a default paragraph about who may collect on

the account (e.g. spouse, if living, but if not, to the surviving children, etc.).

That means the account is payable to the individuals listed in the account agreement.

Multiple party account with right of survivorship (Joint tenancy accounts)

Under the Montana Uniform Multiple-Party Accounts Act, an account owned by more than

one person is known as a Multiple-Party Account. This type of an account is owned jointly by all parties.

If the decedent owned the account with other individuals with right of survivorship

(the most common form of joint ownership), the surviving individuals can legally remove the money. Each owner has the power

to make transactions or withdraw the total amount on deposit according to the deposit

account agreement.

Upon the death of a joint owner, ownership of the account transfers to the surviving

joint owner(s) regardless of any provisions the decedent may have made in a written

will.

Example: Debbie states in her will that she bequeaths all property to her niece, Bethany.

However, Debbie has a certificate of deposit (CD) in joint tenancy with her son, Chris.

Chris will receive the CD because of the joint tenancy with right of survivorship

title. If Debbie wants Bethany to become the beneficiary of the CD she needs to sign

a new form and list Chris as a joint owner. Once the change is accomplished, Debbie’s

written will controls who receives the CD upon her death.

If a dispute arises between the surviving joint owners about withdrawals or transactions

made by one of the owners, that disagreement is between the owners and not the financial

institution holding the account.

Multiple party accounts without rights of survivorship are not common and are beyond

the scope of this MontGuide. Further information is available in the MSU Extension

MontGuide, Dying Without a Will in Montana (MT198908HR),or request a copy from your local Extension office. Also, an interactive website

illustrating how a deceased person’s estate is distributed when a Montanan passes

away without a will is at available at www.montana.edu/dyingwithoutawill.

Single party account with POD or TOD beneficiary designations

If the decedent was the sole owner of an account and made a payable on death (POD) beneficiary designation, then under Montana law the POD beneficiary is entitled

to the funds. While the sole owner is alive, the POD beneficiary does not have ownership

or access to the account.

The procedure for an estate over $100,000 and $100,000 or less only applies if there

is not an account agreement stating where the funds go by default. Without a signed

agreement, the account proceeds would be payable to the estate.

Before the financial entity will release the funds, the POD beneficiary will be required

to present the decedent’s certified death certificate and the beneficiary’s proof

of identification. Typically, most financial institutions will require an unexpired

government-issued photo identification, such as a driver’s license, passport or state-issued

ID available at the driver’s license offiice.

If more than one POD beneficiary is designated on the account, the financial institution

will split the money equally among the beneficiaries.

Example: Jim established a $100,000 share certificate at his local credit union. The account

was in his name only, with his five children listed as POD beneficiaries. Upon his

death each child received one-fifth of the $100,000, or $20,000 apiece.

The beneficiary on a POD account receives the funds regardless of any provisions the

decedent may have had in a written will.

Example: Bernie has a small savings account, with her son and daughter listed as the POD

beneficiaries. Bernie states in her will that she bequeaths all property to the Montana

State University Alumni Foundation. Bernie will need to remove her son and daughter

as the POD designees if she wants her written will to control the distribution of

her savings account. Bernie could also change the POD designation from the names of

her son and daughter to the Montana State University Alumni Foundation.

A transfer on death (TOD) registration on securities – such as stocks, mutual funds, money market funds,

and corporate or municipal bonds – achieves what the POD designation does for funds

deposited at banks, savings and loans, and credit unions. In other words, the securities

pass to the TOD registrant once the individual presents proof of identification and

the decedent’s certified death certificate.

The beneficiary on a TOD account receives the securities regardless of any provisions

the decedent may have had in a written will.

Example: Barbara has securities on which she has designated her brother, Charles, as the

TOD beneficiary. In her written will, she has bequeathed all property to her sisters.

Her two sisters will not receive the securities unless she removes her brother’s name

as the TOD beneficiary. If the account was solely in Barbara’s name, she could name

her sisters as TOD beneficiaries or she could leave the account to her sisters in

a will.

Single party account without a POD or TOD beneficiary designation

Montana statutes provide procedures for distributing financial accounts that were

solely owned by a decedent who did not make a POD or TOD designation.

These procedures for estates over $100,000 or $100,000 or less only apply if there

is not an account agreement stating where the funds go by default. Without a signed

agreement, the account proceeds would be payable to the estate.

Example: Sandy died owning a vehicle valued at $25,000 that had a $12,000 lien held by the

bank on the title. The value of the vehicle for inclusion in the estate is $13,000

($25,000 - $12,000 = $13,000).

The value of an estate of the decedent is established as of the date of death. When

calculating the value of the estate, the following are not included: multiple party

accounts with right of survivorship, single party accounts with POD or TOD beneficiaries,

and any other property held in joint tenancy with right of survivorship that entitles

the surviving owners to the property on the death of one of the owners. Consult an

attorney to determine if there are other assets that could also be excluded, as type

of assets varies from individual to individual.

Procedure for estates with values over $100,000

If the decedent’s entire probate estate, minus liens and encumbrances, is valued at

over $100,000, the funds in the accounts are considered part of the estate and the

accounts are distributed to the legal heirs through probate. Probate is the legal process of settling an estate and distributing the decedent’s real and

personal property to the legal heirs.

The probate process is usually initiated by a member of the decedent’s family or an

attorney, who notifies the district court in the county where the decedent had lived.

When a personal representative needs to be appointed, the clerk of the court or district

judge appoints one as provided for in the decedent’s will or, if there is no written

will, from a priority list provided in Montana statutes. The court issues a “letter

of appointment” that is used by the personal representative when they collect the

decedent’s real and personal property for distribution to the heirs.

Once the decedent’s property is collected, it is distributed by the personal representative

to the successor(s) according to the decedent’s written will, or if the decedent had

no will according to Montana’s law of intestacy (dying without a will).

When the decedent’s entire probate estate is valued at more than $100,000, the personal

representative must provide the financial entity with a copy of the Letter of appointment

and identification to collect funds in a single party account with out a TOD or POD

beneficiary designation. Multiple party accounts with rights of survivorship and single

party accounts with POD beneficiary designations are not part of the probate process.

These assets are distributed as

explained previously.

Additional examples of property distributed outside the probate process include: property

held in trust; life insurance payable to a named beneficiary other than the estate;

assets in a pension plan; signed account agreements that have default POD designations;

POD beneficiary designations; and transfer on death (TOD) registrations on securities

and securities accounts. These properties pass to the successor designated in the

contracts.

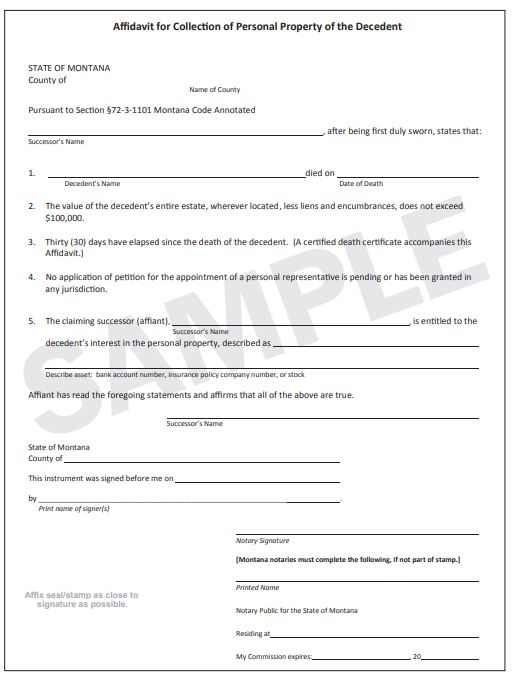

Procedure for estate values of $100,000 or less

If the decedent’s entire probate estate, minus liens and encumbrances, is valued at

$100,000 or less, Montana law pro vides for a simplified procedure without probate

or appointment of a personal representative. The financial entity can release the

decedent’s funds to a successor who presents proof of identification, the decedent’s

certified death certificate, and an Affidavit for Collection of Personal Property of the Decedent (see page 4). The form is also

available to download at https://www.montana.edu/estateplanning/affidavitforcollectionofpersonalpropertyforpdffillableform.pdf.

The Affidavit for Collection of Personal Property of the Decedent must include the statements on the sample form on page 4.

The Affidavit for Collection of Personal Property of the Decedent must be signed by the person claiming to be the successor and the signature must

be notarized by a notary public.

After the affidavit, successor’s proof of identification, and the decedent’s certified

death certificate are presented, the financial institution can disburse the funds

to the affiant (successor). Some financial institutions may ask the successor to sign

an indemnity agreement. This agreement releases the financial institution from any

liability pertaining to the release of funds to the affiant.

If more than one person signs the affidavit, a financial institution will typically

make the check payable to all the successors jointly so all would have to endorse

the check for it to be cashed.

Financial institutions paying, delivering, transferring, or issuing personal property

under the affidavit are discharged and released of liability to the same extent as

if they had dealt with the personal representative of the decedent.

A transfer agent of any security (such as stocks and bonds) is required to change

the registered ownership on the books of a corporation from the name of the decedent

to the name(s) of the successor(s) upon presentation of the affidavit, proof

of identification and the decedent’s certified death certificate.

Summary

Montana law provides simplified procedures for successors to acquire decedent’s accounts

at financial institutions such as banks, credit unions, or other financial entities,

such as brokerage firms and stocks or bonds companies.

If the decedent held the account in their name and also with another individual(s)

with rights of survivorship, the surviving joint tenant can legally remove the monies.

If the financial account is solely owned by the decedent with a payable on death (POD)

or transfer on death (TOD) designation, then under Montana law the POD or TOD beneficiary

is entitled to the funds.

If the decedent’s probate estate (less liens and encumbrances) does not exceed a value

of $100,000, the successor can collect money in the decedent’s accounts by presenting

their proof of identification, a certified death certificate, and an Affidavit for Collection of Personal Property of a Decedent.

Further Information

Montana State University Extension has other Estate Planning Publications at https://www.montana.edu/estateplanning.

Disclaimer

This publication is not intended to be a substitute for legal advice. Rather, it is

designed to help families become better acquainted with the procedures under

Montana Codes for Collection of Personal Property by Affidavit, mult ple party accounts

(joint tenancies), PODs and TODs. Future changes in laws cannot be predicted. Therefore,

statements in this MontGuide are based solely upon those laws in force on the date

of publication.

Acknowledgment

This MontGuide has been reviewed by members of the following professional organizations:

- Business, Estates, Trusts, Tax and Real Property Section: State Bar of Montana

- Montana’s Credit Unions

To download more free online MontGuides or order other publications, visit our online catalog at https://store.msuextension.org, contact your county or reservation MSU Extension office, or e-mail orderpubs@montana.edu.

Copyright © 2023 MSU Extension

We encourage the use of this document for nonprofit educational purposes. This document

may be reprinted for nonprofit educational purposes if no endorsement of a commercial

product, service or company is stated or implied, and if appropriate credit is given

to the author and MSU Extension. To use these documents in electronic formats, permission

must be sought from the Extension Communications Director, 135 Culbertson Hall, Montana

State University, Bozeman, MT 59717; E-mail: publications@montana.edu

The U.S. Department of Agriculture (USDA), Montana State University and Montana State

University Extension prohibit discrimination in all of their programs and activities

on the basis of race, color, national origin, gender, religion, age, disability, political

beliefs, sexual orientation, and marital and family status. Issued in furtherance

of cooperative extension work in agriculture and home economics, acts of May 8 and

June 30, 1914, in cooperation with the U.S. Department of Agriculture, Cody Stone,

Director of Extension, Montana State University, Bozeman, MT 59717